Invest in your financial success.

Latest updates

Why Modena works for you

-

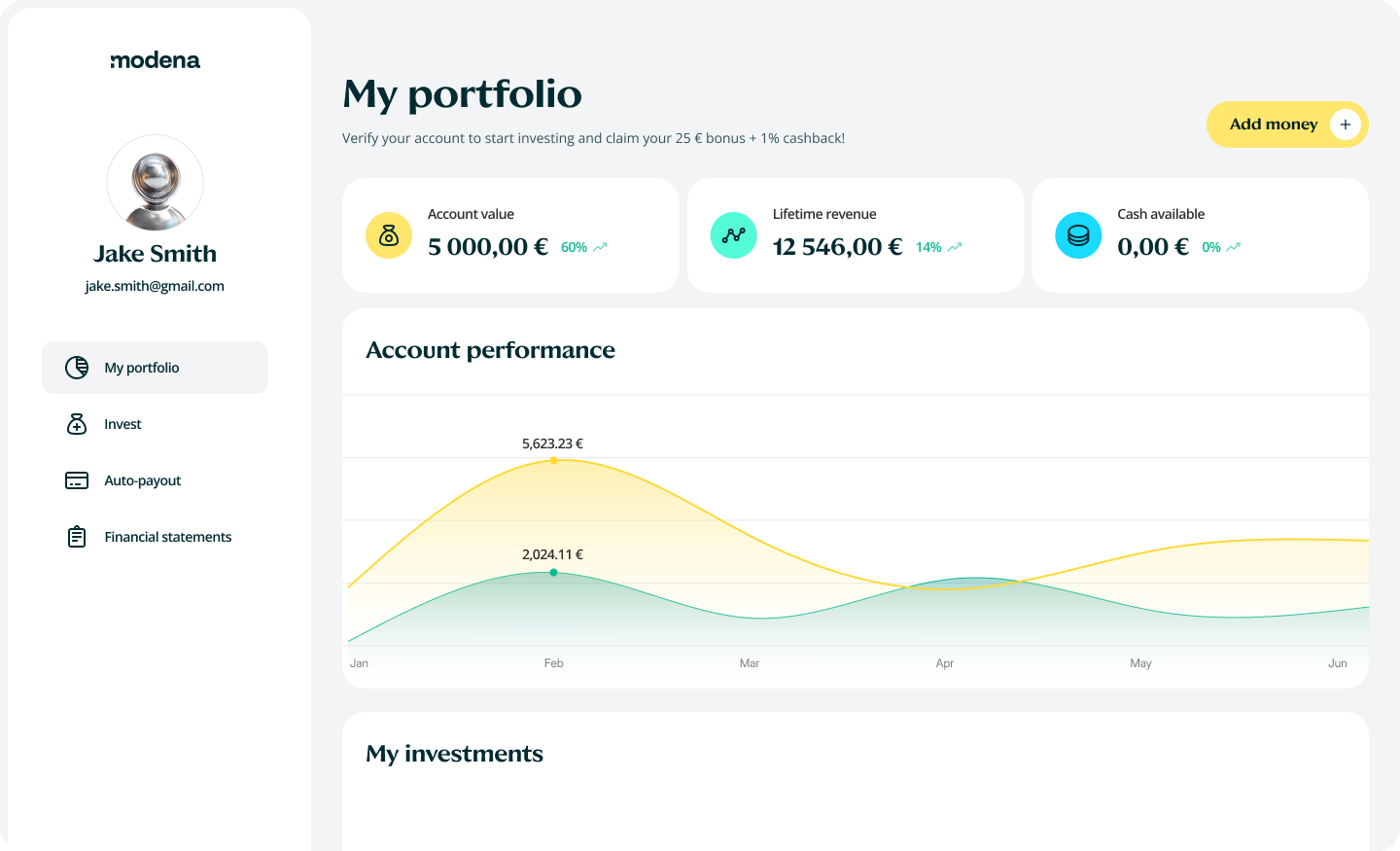

Transparent returns Modena offers a platform where you can buy consumer loan's and Buy Now, Pay Later claims and earn 11% p.a on the investment. -

Automatic payouts You can set a percentage of the revenue that you earned on the platform that will be automatically paid out to your IBAN beginning of every month. -

Buyback guarantee Modena offers a buyback guarantee. All the loans that are 35 – 90 days late will be bought back.

-

Start with 50 € You can start on Modena's platform with as little as 50 €. It's always possible to increase the committed amount at any time later -

Automatic process Once you have deposited the funds, the platform automatically buy claims arising from Modena's loans and Buy Now, Pay Later contracts. -

User support Modena commits to supporting their platform users with whatever topics or questions they might have. Our phone lines and email are always open to questions, suggestion and feedback.

- Established at

- 2024

- Average annualized earnings

- 12.34 %

- Number of users

- 1 092

- Total Investments

- +14M €

How Modena Capital works

Your money grows with us

The revenue you earn is automatically added to your portfolio, so you start earning interest on both your initial money and the revenue.

Over time, this helps your portfolio to grow faster and faster.

Ready to start earning today?

Understanding risks and protections

Our comprehensive screening system examines credit history, income verification, debt-to-income ratios, and behavioral patterns to ensure only creditworthy borrowers receive funding. We are not a subprime lender.

Each investment is distributed across loan pools, containing hundreds of loans, ensuring no single default significantly impacts your returns. Our algorithm optimizes diversification based on risk profiles.

We maintain full compliance with EU financial regulations, undergo quarterly audits, and submit regular reports to regulatory authorities. Your funds are held in segregated accounts.

Our reserve fund is maintained at 15% of outstanding loan value, exceeding regulatory requirements. This ensures we can honor our buyback guarantee even in worst-case scenarios.

Every investment carries some risk and past earnings are not a guarantee of future performance. It is important for everyone to understand how the platform works, what are the risks involved and what actions has Modena taken to mitigated them.

Read the risk policy here.

Book a free consultation with our Head of Finance who will give you a comprehensive overview of Modena’s risk policy. Contact support to book a call.