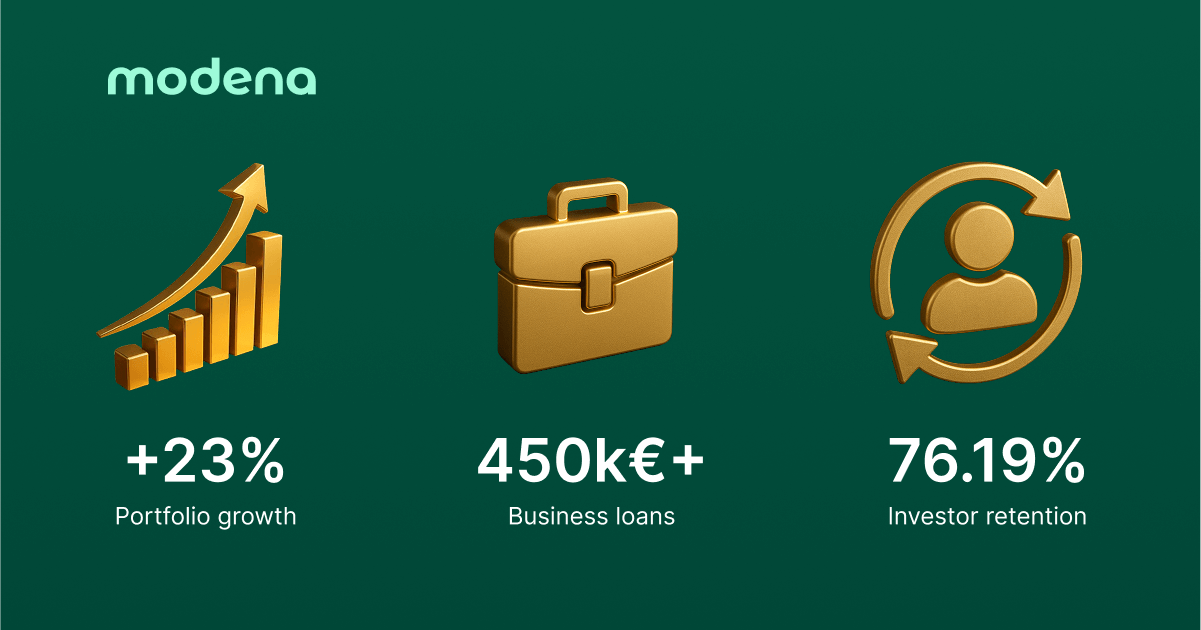

June marked our strongest month to date in business loan growth. The loan portfolio expanded by 23%, bringing total active lending above €450,000.

This growth reflects the consistent execution of our asset allocation strategy and an uptick in engagement from both passive and active investors.

Our lending focus remains on small and mid-sized businesses across commerce, manufacturing, and real estate development—sectors selected for their stable cash flows and alignment with our credit standards. These include minimum debt coverage ratios and confirmed revenue performance.

Our platform offers diversified access to private credit opportunities, designed to complement conventional vehicles such as mutual or index funds.

The investor retention rate currently stands at 76.19%, reflecting confidence in our lending process, portfolio discipline, and ongoing performance.

Modena Capital operates within Estonia’s regulated, digital-first financial environment. Investor funds are held in segregated accounts, and returns are calculated monthly. Performance data is made available for transparency and monitoring purposes.

We remain focused on maintaining a disciplined, transparent approach as we enter Q3. Thank you for your continued trust.